ROI of DeFi Projects: How to Calculate

In early 2021, we saw DeFi projects and coins like Uniswap skyrocketing in value before the Bitcoin market went down. Moreover, back then, the DeFi industry reached an all-time high of $90 billion in total reserved value (TVL), making a significant contribution to the cryptocurrency market's capitalization. But you might be wondering: what is really driving this DeFi hype, and how can you capitalize on it? Below, you will find information about the best projects with high DeFi ROI and how this indicator is calculated.

How Is DeFi ROI Calculated?

You need to divide the profit earned on your DeFi investment by the cost of that investment. The DeFi sphere is one of the most attractive for investors and a rapidly growing branch of the cryptocurrency market. It attracts many with the prospect of potentially high earnings coupled with relatively low risks. Yield farming is a way of investing in cryptocurrencies. An investor places funds in a specific protocol based on smart contracts that distribute these funds by loaning them to other people.

Is There Any Calculator?

Investors prefer to use special virtual services that help them calculate the ROI of DeFi investments considering all factors, such as DeFi service fees, liquidity, and asset exchange rates in the pool. However, there are only a few trusted services provide calculators to help investors calculate their return on investment. For instance, a digital DeFi ROI calculator that takes interest rates over the last 30 days to calculate daily income.

Why ROI Is So Important?

ROI plays a key role in any kind of investment, and cryptocurrency is no exception. In contrast to trading, investing usually takes a long-term approach to building wealth. An investor's goal is to accumulate wealth over a long period (years or even decades).

The general formula for ROI can be explained like this:

ROI = (Current Investment Value - Initial Investment Value) / Initial Investment Value

A higher ROI can be achieved by increasing profits and reducing costs. While this may increase the ROI of DeFi projects, it can lead to higher costs and cause performance problems for the crypto project later on.

What Are DeFi Tokens That Have the Highest ROI?

When you invest in a cryptocurrency, always check its white paper, the team working on it, how the cryptocurrency works, and its intended use cases. Some of these DeFi tokens are up over 500% in the last six months with strong fundamentals.

The top 5 DeFi tokens by market capitalization are:

Let’s take a closer look at these tokens, their main features, and their efficiency.

AAVE

A DeFi protocol allows you to lend and borrow crypto assets at variable and fixed interest rates.

Initially, the platform used a peer-to-peer (P2P) model where users interact through smart contracts. However, the disadvantage of the scheme is in the possible lack of counterparties and liquidity for the effective implementation of operations. Therefore, the creators decided to move to the peer-to-contract (P2C) model that most DeFi protocols use.

On a P2C platform, funds are deposited through a special contract, which allows you to instantly borrow crypto assets with interest paid for using credit funds. Two categories of participants interact on the platform: borrowers and lenders.

As long as liquidity is provided in the protocol, aTokens can be redeemed based on a 1:1 ratio to the underlying asset. The balance of such coins grows by the current interest rate of the protocol. Investors can check the actual fluctuation using a DeFi ROI calculator.

The market capitalization of Aave is $1,886,891,171 USD.

Source: Coingecko

Kyber Network Token

The Kyber Network liquidity protocol allows decentralized token swaps to be integrated into any application, thus ensuring a seamless exchange of value between all participants in the ecosystem.

Using the protocol, developers can create payment flows and financial applications, including instant token exchange services, ERC-20 payments, and innovative decentralized finance (DeFi) applications, helping build a world where any token can be used anywhere.

KNC allows token holders to play a critical role in setting an incentive system, creating a broad stakeholder base, and facilitating the economic development of the network. A small fee is charged every time a token exchange occurs on the network, and KNC holders can vote on this payment model and distribution and other important decisions.

Their Kyber Network Crystal (KNC) token currently ranks among the top 100 cryptocurrencies by market cap, while the Defi ROI has reached 300%.

Source: Coingecko

Elrond

It is a blockchain platform for building high-performance and secure applications (DApps) based on smart contracts. In addition, the platform creates a global digital economy by enabling blockchain interoperability.

The Elrond network can process up to 15,000 transactions per second, making it one of the most effective blockchains. In addition, transactions in Elrond are confirmed almost instantly. In comparison, Ethereum can handle up to 15 TPS, and Tron can process up to 1000.

Such a high throughput can be achieved through segmentation (sharding): the network is divided into several interconnected fragments (shards) that can operate parallel. This increases performance and transaction speed. The same principle is being implemented in the Eth 2.0 update, but sharding is already working in Elrond while their token is being traded on Binance. The Defi ROI for private investors is 7x.

Source: Coingecko

Bancor Network Token

Bancor is an on-chain liquidity protocol that can be implemented on any blockchain supporting smart contracts. It runs on the Ethereum and EOS chain, but this protocol can be easily deployed on other blockchains as they are meant to be interoperable.

The system allows you to simplify the conversion of virtual currency tokens among themselves without conducting centralized cryptocurrency exchanges. The Bancor ecosystem supports a two-way token model: liquidity tokens and relay tokens.

A liquid token is an automated token with a single reserve, which releases and destroys itself. To do this, the protocol either sends a reserve token to its smart contract or removes it from the smart contract. To use the Bancor Network, a liquid token must have its reserve token in either BNT or a BNT derivative.

Relay tokens are used in staking to provide yield. Token holders receive a percentage of Bancor's future earnings. Relay tokens indicate the amount staked relative to the total value of the pool.

The market capitalization is $549,869,989. Investors can calculate the token profit using a DeFi ROI calculator online as provided below.

Source: Cryptoground

Source: Coingecko

Synthetix Network Token

Synthetix is a derivatives liquidity protocol on Ethereum that allows you to issue and trade synthetic assets. There is a wide range of synthetics at Synthetix, including fiat currencies, cryptocurrencies, commodities, and indices. The system can support any asset with a precise price and provide on-chain access to an unlimited range of tangible assets. In addition, the protocol comes with many trading features, such as binary options, futures, and more.

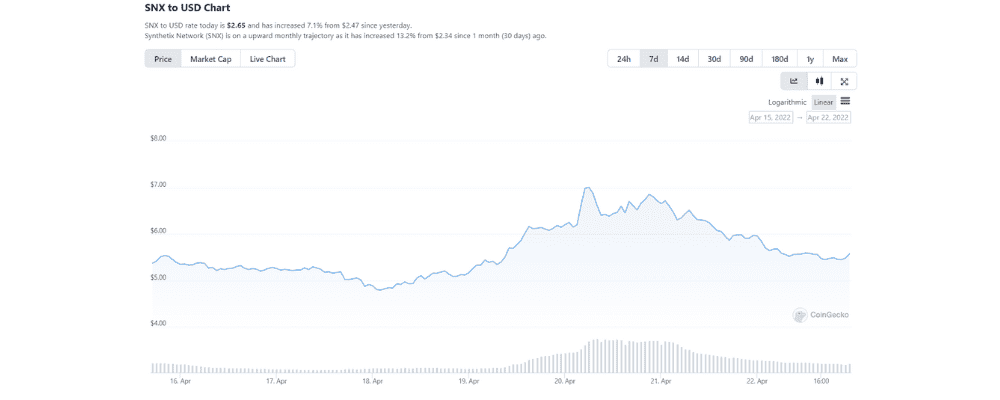

SNX is currently the most actively traded on the Binance market. The number of coins in circulation ranges between a minimum of 110 million coins and a maximum of 193 million coins. The market capitalization reached $644 million at the end of December 2021. The security rating of the token is currently above 3 out of 10. The Defi ROI amounts to 2032.39%, and the price is expected to rise above $15 in 2022.

Source: Coingecko

What Is DeFi?

This is the definition of DeFi: it is a decentralized, public, and trustless ecosystem of financial applications/services based on blockchains. The ecosystem of decentralized finance can provide anyone with access to traditional financial services, eliminating the need for intermediaries and lowering entry barriers.

Why DeFi Projects Are Good for Investment?

The volume of funds blocked in DeFi protocols increased from $0.9 billion in January 2020 to $240 billion in October 2021. The figure is huge, but it is less than 1% of the market potential. In the long run, the market could grow even more than 100 times.

This interest is that DeFi is practically the only way to receive recurring fixed income in cryptocurrencies. As a result, there is a steadily high DeFi ROI, and the annual percentage yield (APY) in the top 5 DeFi protocols ranges from 15% to 166%.

Conclusion

News about changes in the decentralized finance market is constantly appearing on the network. In 2021, we could already talk about the high level of maturity. At the same time, the market is waiting for new stages of growth. The development prospects suggest that investors still have many opportunities to invest in DeFi profitably. Upon deciding to invest in such a protocol, the user needs to choose promising projects with a quite attractive DeFi ROI and reliable references from other investors.

Frequently Asked Questions

How Is DeFi ROI Calculated?

The DeFi ROI calculation is based on the following equation: ROI = (present value - total cost) / total cost. Alternatively, this can also be written as ROI = Net Income / Net Worth

Why Is ROI of DeFi Projects Important?

The ROI of DeFi investments is a ratio or percentage that reflects the profitability or performance of a particular investment. Therefore, it can be used when comparing different types of investments or multiple trades.